You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

How 'bout that stock market?

- Thread starter Ski_Banker

- Start date

- Joined

- 18 July 2005

- Messages

- 2,636

So for the non daytrader. People with mutual funds, 401k's, etc. What do youguys think, cash out for the next 12 months?

Keep funding and keep buying. Last year was the time to be selling. But I only know that in hindsight.

I'd stay invested if I were in your position. Too tough to call a bottom and a lot of equities are very cheap if we don't go into recession (or get a very mild one). You also must remember that Wall Street is 6 to 9 months forward looking, so if you think we'll have a path to resolution 18-21 months from now then you should stay put.

BTW, my style of investing wouldn't be considered day trading. :wink:

This is good to hear. I have been playing around a tiny bit in the stock market but most of my money is sitting in mutual funds, and I'm saving/investing as fast as I can right now before I go to grad school. It's nice to know that I'm doing the right thing, especially when even at the good pace I'm saving and investing at, I'm still at about the same total $ figure as on New Year's :frown:Keep funding and keep buying. Last year was the time to be selling. But I only know that in hindsight.

- Joined

- 18 July 2005

- Messages

- 2,636

Good luck with grad school.

I'm not even married and its kicking my ass.

What kind of funds you hold? You keeping an eye on sales charges, expense ratios and management?

Do you have a Roth along with your 401(k)?

I'm not even married and its kicking my ass.

What kind of funds you hold? You keeping an eye on sales charges, expense ratios and management?

Do you have a Roth along with your 401(k)?

- Joined

- 18 July 2005

- Messages

- 2,636

LOOK OUT BELOW!

- Joined

- 1 September 2001

- Messages

- 4,123

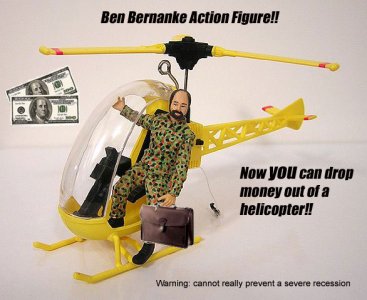

PPT seems to be on top of it;-)

- Joined

- 18 July 2005

- Messages

- 2,636

I shorted aapl this morning at 129.15 and was hopeing for a 20-30 cent drop but I covered it at 127.12 BAWHAAAAAAA:biggrin: OMG I can't believe it.

hahaha...nicely done. :biggrin:

The investment banks are far better positioned than commercial or retail banks. Not only do they not hold these shitty loans, but they can participate in future restructuring advisory and equity cap markets work.

That said, I still wouldn't buy any of 'em now. Not at all...

Also:

Dividends can, and will, be cut...

Can you say Bear Stearns...

- Joined

- 1 September 2001

- Messages

- 4,123

Wtf?

AP

JPMorgan Chase Funding Bear Stearns

Friday March 14, 9:23 am ET

JPMorgan Chase, With Federal Reserve Bank of NY, to Provide Funding to Bear Stearns

NEW YORK (AP) -- JPMorgan Chase says that in conjunction with the Federal Reserve Bank of New York it will provide temporary funding for Bear Stearns.

The funding will be provided as necessary for up to 28 days. During that time, JPMorgan Chase will also help Bear Stearns find permanent financing.

There has been speculation this week that Bear Stearns was struggling with liquidity problems. Its chief executive earlier denied those reports.

AP

JPMorgan Chase Funding Bear Stearns

Friday March 14, 9:23 am ET

JPMorgan Chase, With Federal Reserve Bank of NY, to Provide Funding to Bear Stearns

NEW YORK (AP) -- JPMorgan Chase says that in conjunction with the Federal Reserve Bank of New York it will provide temporary funding for Bear Stearns.

The funding will be provided as necessary for up to 28 days. During that time, JPMorgan Chase will also help Bear Stearns find permanent financing.

There has been speculation this week that Bear Stearns was struggling with liquidity problems. Its chief executive earlier denied those reports.

hahaha...nicely done. :biggrin:

That was all luck!!! before I even had the chance to blink I was up 5k.

Markets are always fun to trade with billions of liquidity are slammed onto them all at once.

I'm laying off the loud pedal in the S&P this morning. The swings are massive, the tape is going ape shit... there is a 1 pip spread in the friggin' pit for gods sakes. A historical morning for sure.

Gonna try and find some entries this afternoon. Also looking to play some scalp bounces in the currencies off the news as well.

I'm laying off the loud pedal in the S&P this morning. The swings are massive, the tape is going ape shit... there is a 1 pip spread in the friggin' pit for gods sakes. A historical morning for sure.

Gonna try and find some entries this afternoon. Also looking to play some scalp bounces in the currencies off the news as well.

Thanks! Yeah I'm still young (about to turn 24) and single, so I'd better do it sooner than later.Good luck with grad school.

I'm not even married and its kicking my ass.

What kind of funds you hold? You keeping an eye on sales charges, expense ratios and management?

Do you have a Roth along with your 401(k)?

I'm holding:

Janus Twenty (JAVLX)

Janus Fundamental Equity (JAEIX)

Gabelli Asset (GABAX) - I picked this fund when I was 10!

T. Rowe Price Spectrum Growth (PRSGX)

Vanguard Windsor II (VWNFX)

Fidelity Canada (FICDX)

All their costs are pretty low. I've maxed out my Roth since I got my first job at 16.

Thanks! Yeah I'm still young (about to turn 24) and single, so I'd better do it sooner than later.

I'm holding:

Janus Twenty (JAVLX)

Janus Fundamental Equity (JAEIX)

Gabelli Asset (GABAX) - I picked this fund when I was 10!

T. Rowe Price Spectrum Growth (PRSGX)

Vanguard Windsor II (VWNFX)

Fidelity Canada (FICDX)

All their costs are pretty low. I've maxed out my Roth since I got my first job at 16.

You are the shining example of what to do while you are young. KUDO'S!!!!!

Well boys... you know how I was trying to get back into the ES and show it whos boss this week? I just took +6 out of the mother in about 5 minutes. Textbook signal that fit my criteria... put it on, and wham, bam, thank you man... 300/per in the bank. I just had to share with someone... I'm STOKED RIGHT NOW! Thats what you get for following your rules to a T.

+6 is like 3x's what I would've taken home in the old days on a "good day"...

I'm gonna make this thing my bitch.

+6 is like 3x's what I would've taken home in the old days on a "good day"...

I'm gonna make this thing my bitch.

- Joined

- 18 July 2005

- Messages

- 2,636

Silverstone I know you HAVE to be trading today most likely AAPL.

I am having a really good day. :biggrin:

Steve, you don't even want to know. :wink:

Steve, you don't even want to know. :wink:

Easy money today. :smile:

Thanks a lot! I just hope I can hold onto as much of it as I can through grad school. If I decide to go full-time MBA my food and rent is gonna have to come from somewhere :frown:You are the shining example of what to do while you are young. KUDO'S!!!!!

- Joined

- 18 July 2005

- Messages

- 2,636

- Joined

- 1 September 2001

- Messages

- 4,123

All open markets are down...

http://newsvote.bbc.co.uk/1/shared/fds/hi/business/market_data/stockmarket/11827/default.stm

http://newsvote.bbc.co.uk/1/shared/fds/hi/business/market_data/stockmarket/11827/default.stm

EEV/FXP large gains for me.

Closed half of my remaining SKF/QID.

I'm about to pull the trigger on CME.

Closed half of my remaining SKF/QID.

I'm about to pull the trigger on CME.

- Joined

- 1 September 2001

- Messages

- 4,123

Similar threads

- Replies

- 4

- Views

- 223

- Replies

- 10

- Views

- 299