John you're absolutely right about a lot of chatter (BS) on forums, but I'm not sure what you're saying here. Is the chatter on this forum any better than the others? Trackpedia, being all about tracking, appears to me to be a little more hardcore than Prime and has attracted posts from actual providers.

Ted, It seems like a good site, I really liked the idea and I regularly use it for reference on track stats.

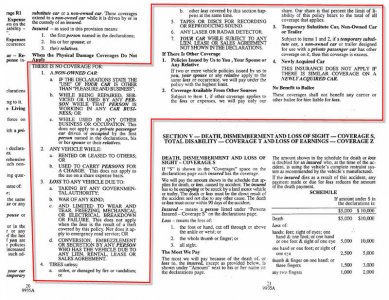

On the insurance thing... Ok, for one I think the core problem across all the sites that leads to the most confusion is that providers underwrite different policies in different states. Simply because State Farm covered a DE accident in one state for one policy holder for a specific incident most definitely doesn't mean the same might apply for another policy holder in another state under another set of circumstances.

So, the common question "Does X provider exclude coverage for..." seems irrelevant to me. A better question might be "Has X provider in X state ever paid out on a track claim in the past, what was the disposition, and have they since adjusted their policies". In many situations it could well come down to a specific interpretation of events as you are essentially asking them to make the call on something that is already on a grey line like the definition of "preparation for racing" which is right up there with "PC load Letter".

Two, people often don't talk about payouts and other such things on the internet as it is a private personal matter and generally a bad idea nor in their best interest. There is no public clearing house for data so anyone can make up anything they want without challenge.

In the end... neither of those points lends itself well to disseminating good information to driving enthusiasts that are just looking for the bottom line here. Do they have coverage or not and to what extent? I don't know about the rest of you but I don't care what some guy on a forum says is covered, I want it in highly explicit writing. That's how business gets done.

I read more up on that thread, still, going in circles like every other one. Especially for novices that just want to have a good time at their first track day with their sexy new automobile... I feel there is very little good info there on these types of threads.

Not to get too long on the tooth here... but for those whom are seeking track coverage I say pick your poison... talk it up however you want there are only a handful of options:

Generalist Auto Insurance:

Hoping for a little track coverage from your local friendly agent because the words "timed" or "racing facilities" is missing from their exclusion list? I think it is a high calculated risk on a higher dollar car. Learn your lessons or take the blue bill, and know that sometimes it is bitter to swallow.

IMHO customer loyalty / satisfaction is long dead in America here. People buy expensive street cars often with 500+ rwhp that they can't handle, then they want cheap car insurance, and companies happily line up to give it to them with few checks. They buy crappy "actual cash value" policies with bare state minimum limits because a cute talking lizard told them they could save some money on their car insurance- not because they really wanted the best coverage and hired a lawyer to compare all the available legalese among available policies from providers in their state. Not because they checked civil records in superior court for recent successful law suites or denied claims. Even minor civil fender bender incidents can see north of a half a mil rewarded... think you really have sufficient coverage without an umbrella racing around because you signed a disclaimer on the way in the door? Find me a top tier pro racing team (a business) that operates like that... none.

Sure, club sports car and HPDE enthusiasts often tend to think of themselves as being more savvy consumers, and sure they read every last line of their policies... but it's still difficult to relevantly compare coverages let alone internal policies between the lines for a licensed agent at the office let alone at home in your kitchen.

There is a lot of consolidation in the last few years in the industry. The traditional role of agents has been changing. As a consumer, one of my long standing bitches to the office of the insurance commissioner has been to try and get an insurer to send you an actual copy of a policy for your state without first binding coverage with them. Call around and ask about faxing over explicit exclusions from generalist providers and you'll get a lot of unreturned calls or ambiguous responses from CR reps that truly have no idea what they are talking about, often not even being licensed. How is a modern savvy customer supposed to compare providers if that tactic is to become widely pervasive? How do you know what you are really paying for or if you are comparing apples to apples? Go check out all the top tier provider sites and find me policy wording on their web sites for the states in which they are licensed to sell- all they want to talk about is rates and their 24/7 phone line. Claims? Yeah, that's another phone number. This is fast becoming a new hot topic with many lawmakers.

Ask anyone in the industry, a Katrina or Andrews victim, etc... and they will be the first to tell you not all auto policies are created equal on any number of points. Policies toward DE days, under-age drivers, catastrophic events, aftermarket equipment, coverage while trailering, coverage for expensive bikes while racked, replacement parts, what percentage is "totaled", definitions for "replacement value", "equivalent replacement parts", "modifications", etc... all vary and people need to understand what they are paying for versus what coverage they are actually receiving- in advance.

To make it more difficult to compare two generalist providers... policies can be amended anytime a client renews. The trend thus has been that the duration keeps getting shorter, often as little as 4 or 6 months as they want to be more 'agile'. Their is nothing that has curtailed the industry from using inaccurate Choice Point data or imposing credit checks and other questionable practices. Their is a lot of industry hot terms like "underwriting accountability" and as such the days of friendly helpful agents are fast coming to an end- "friendly agent" right... the 800 CR reps are watching their own back....

Think they always play by the rules? Pick-up the phone. In theory you pay per vehicular coverage yet the first question they ask anymore is if their are any underage drivers in your household and what their social security number is. Regardless if they have their own license and/or coverage they can still jack up your rates or flat out deny you coverage and then use something unrelated as the formal explanation. They are limited to a three year driving abstract but their first question is if you've had any tickets in five or ten years while they hand out free lasers to ticket you with...

Again, I've read all the chatter. Take my post as a reality check.

Personally, I highly doubt it would matter if you were a paying holder in good standing for 25 years... the goal for large corporate generalist providers in an economy of scale is to minimize payouts. Period. You stuff a six figure plus sports car with your car club "untimed advanced open lapping" or not and I feel pretty confident that if there is a way out under the policy wording rest assured they will find it; and if they can't because they dropped the ball on their policy wording then they will next time if it starts to become a problem for them.

This is to say nothing about medical, which any of the doctors on nsxprime will tell you to don't always count on them for that extra cat scan.

Specialty Track Insurance.

Track insurance has a lot of advantages as I mentioned in my earlier post for the basic problem... coverage of expensive hardware. This is where I steer those newbies without the confidence whom are really worried about piece of mind.

I think the advantage with the track insurance is that it is very clear on its specialty intent with highly explicit written coverage.. which is loads better over wishful thinking with the generalists. It is insurance from club guys to club guys. The owners are often veteran drivers instead of paranoid wussies and thus actually understand club motor-sports and what risks are actually being assumed- as opposed to blowing things way out of proportion making DE days with limited passing more than they are or calling it "racing". They have a reputation in a small circle, which is their check and balance. They understand that the reality is that most events go without a hitch, and believe me if the sponsoring club has to write too much paperwork national will be asking the organizers questions.

Further, they are all "stated value" or the better "agreed value" policies which is best for all parties in the event of a claim. Hopefully, going forward more of these will arise as club motor-sports gains in popularity. Maybe you could just show them your 'S' license and be good to go, who knows.

Your insurance

Your insurance

This is the best option IMHO. What needs to be said? Track what you can afford. Yes, that might be a race prepped dodge neon but that doesn't mean it has to be slow.

Conclusions...

Bottom line... the way I see it, is "auto insurance", "track insurance", "your insurance", or otherwise- you still have to dial it down one notch so as to keep it sunny side up. If you can't do that and need to go 11/10ths dive bombing fender to fender or think you are some invincible bad ass driver then you really need to buy something you can afford to field and repair on your own dime (or whore yourself out to 50 fat chicks or whatever you have to do to go fast). :biggrin:

In the end, insurance is like everything else in life, you only get what you pay for.