Well buying my 1st home, seller took my offer. Is it normal to be really nervous?

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Buying 1st home

- Thread starter Nukem

- Start date

Yes.....and depends alot on the condition of the home/systems and of course how much money you borrowed.Well buying my 1st home, seller took my offer. Is it normal to be really nervous?

Now is a great time to purchase a home, low interest rates and home values are WAY down. Just pay that sucker off as fast as you can.

Congrats! An historically great time to purchase a home - unbelievably low rates, and lots of homes at great values. Tax deductible interest too. Enjoy!

First home always a bit nerve wracking - but definately improves, and I suspect more "new homes" in your future. Its all good. Cheers! Jay

First home always a bit nerve wracking - but definately improves, and I suspect more "new homes" in your future. Its all good. Cheers! Jay

It should be...you were pre-qualified for a loan, but you must now go through the real loan approval process and hope you get approved. You also need to schedule a home inspection, radon, termite, survey, write down your clauses for things that need to be fixed, and hope the owner gets it done in time before you goto closing. And also hope nothing major in the world happens that will change the current interest rate.

But all that aside, you should have some assurance that this process has been done an uka-billion times before so it's fairly straightforward. Welcome to the club (almost)!

But all that aside, you should have some assurance that this process has been done an uka-billion times before so it's fairly straightforward. Welcome to the club (almost)!

Seven words of advice that, if taken, you will never regret: Get a fifteen-year fixed rate mortgage.

I'll second that advice. We bought our house in 02 with a 15 year and have been adding just a couple hundred bucks to each payment. As a result, the end of the mortgage is in sight already. We will be 100% debt free in a couple more years.

Just laughing at all the people saying this is such a great time to buy a home. Guess it depends where you live.... they sure aren't at historically low prices around here!

Still, congrats and good luck!

Still, congrats and good luck!

I am sure its easier in Omaha if thats where the OP is buying. Fortunately mine in Cali is going back up. As they say its all about "location, location, location"

Being nervous is natural especially on your first house. Curious what are houses going for out there?

Being nervous is natural especially on your first house. Curious what are houses going for out there?

I just bought my first home about 2 months ago. The nervous part doesn't really kick in until you start signing and submitting all the documents. I would also recommend shopping for home owners insurance right now. The bank will probably require information regarding your home insurance before they issue the final loan paperwork. Depending on the bank and contingencies, the escrow can close pretty fast if you have all the ducks in order. Good luck and congratulations.

- Joined

- 18 July 2005

- Messages

- 2,636

Get your HUD statement and pick through it with a fine tooth comb.

Make sure your interest rate is correct, as well as everything else....settlement fees, endorsements, pre paids.....etc. If you see anything in the HUD that seems suspect ask them what it is, and if it is frivolous, tell them to get rid of it.

Get a home inspector that has been in business for a long time. Call around and interview folks over the phone. A good home inspector will help to put you at ease.

Good luck.

Make sure your interest rate is correct, as well as everything else....settlement fees, endorsements, pre paids.....etc. If you see anything in the HUD that seems suspect ask them what it is, and if it is frivolous, tell them to get rid of it.

Get a home inspector that has been in business for a long time. Call around and interview folks over the phone. A good home inspector will help to put you at ease.

Good luck.

I bought my first house when I was 21 and I was nervous as hell. I remember the day I moved in, I was out right panicked. I laid awake that night and listened to everything I had never heard before and all of it cost money, fridge kicking on, furnace running. LOL. Within just a few years I had A LOT more property and was on my way. Today I buy and sell houses like I'm playing monopoly.

I moved back in 08 at the bottom of the market. I was a bit nervous again but not like that first one. I think most of it was moving out of my other house that I had lived in for ~ 20 years.

congrats and good luck to you!

I moved back in 08 at the bottom of the market. I was a bit nervous again but not like that first one. I think most of it was moving out of my other house that I had lived in for ~ 20 years.

congrats and good luck to you!

baynsac

Guest

Seven words of advice that, if taken, you will never regret: Get a fifteen-year fixed rate mortgage.

I'll second that advice. We bought our house in 02 with a 15 year and have been adding just a couple hundred bucks to each payment. As a result, the end of the mortgage is in sight already. We will be 100% debt free in a couple more years.

I am in the process of buying my first home. What are you main reasons that you recommend getting a fifteen-year fixed rate mortgage??

I am in the process of buying my first home. What are you main reasons that you recommend getting a fifteen-year fixed rate mortgage??

IDK what the others think but IMO pay off your personal house as soon as you can. If you get it paid off when you're young you can use the equity to springboard your life. It also puts you in a position to not need work and frees up your time.

I am in the process of buying my first home. What are you main reasons that you recommend getting a fifteen-year fixed rate mortgage??

very low rates coupled with less overall interest payments over 180 months vs 360 months.This assumes you will live in the house for a long time...If this is a starter home then other options may make more sense..

baynsac

Guest

Its my first house, it should be approved by next week according to my real estate agent. Than we go in escrow. I plan on living there myself for a year or 2 than rent it out and sell it when the time is right.(3-6 years from now probably) Or Rent it out right away and buy another property as soon as I can. Eitherway, I also want to buy atleast one and hopefully 2 more properties in the next 5 years. And I am in the mist of almost buying a new business as we speak (gas station) but not the property just the business it self. The reason I mentioned all this is based on what you know now about my plans would you still recommend fifteen-year fixed rate mortgage ? Some of these properties will (may) be in my other family members names. What type of loan would you recommend? Thanks

Last edited:

Where are you buying?

I actually just bought my first house on the 21st.

Did all the normal stuff. Make sure you do a walk-threw before settlement and NOTE anything that's not fixed, or different than the home inspection. I had a clogged toilet that I couldn't get unclogged for the life of me and since then did a few tricks but still doesn't flow as well as I hoped. Making notes of something that has changed makes the owner fix/take action rather than saying "it's yours now".

I have yet to move in since I've been refinishing my old hardwood floors.

Stephen

Did all the normal stuff. Make sure you do a walk-threw before settlement and NOTE anything that's not fixed, or different than the home inspection. I had a clogged toilet that I couldn't get unclogged for the life of me and since then did a few tricks but still doesn't flow as well as I hoped. Making notes of something that has changed makes the owner fix/take action rather than saying "it's yours now".

I have yet to move in since I've been refinishing my old hardwood floors.

Stephen

Congrats man!!!!!

I am 15 days from my 1 year homeowner anniversary. I haven't had the amount of experience that most have here but these are my tips:

1. Inspect the house thoroughly! Even though the inspector will do a lot of things it's always nice to have peace of mind.

2. When signing the paperwork ask questions! You will get a greater understanding if you know the numbers, and what you are signing.

3. Get to know the neighborhood. Talk to the neighbors for any problems of the area(bugs, crime, ect)

4. (If you have a homeowners association) make sure that you can deal with their rules

5. If you can afford to pay more than your normal payment do it. If anything try to make one extra payment a year (however you want to split it). It will save you tons or interest.

...all I can think of right now.

I am 15 days from my 1 year homeowner anniversary. I haven't had the amount of experience that most have here but these are my tips:

1. Inspect the house thoroughly! Even though the inspector will do a lot of things it's always nice to have peace of mind.

2. When signing the paperwork ask questions! You will get a greater understanding if you know the numbers, and what you are signing.

3. Get to know the neighborhood. Talk to the neighbors for any problems of the area(bugs, crime, ect)

4. (If you have a homeowners association) make sure that you can deal with their rules

5. If you can afford to pay more than your normal payment do it. If anything try to make one extra payment a year (however you want to split it). It will save you tons or interest.

...all I can think of right now.

Seven words of advice that, if taken, you will never regret: Get a fifteen-year fixed rate mortgage.

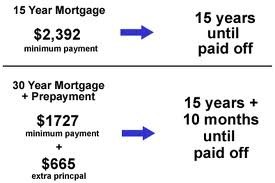

I disagree with this. You can get a 30 year loan and pay it just like its a 15 year. That way if you ever lose your job, have medical issues, etc, you can pay less. Of course this would require you to have the follow through to put the extra money in each month.

"her eyes said '30', but her payments said '15' ".You can get a 30 year loan and pay it just like its a 15 year.

Attachments

Where are you buying?

Around 48th and Giles

"her eyes said '30', but her payments said '15' ".

Yeah got a 30 yr didn't get back to this forum until after we signed the papers for the loan, but I can afford double the morgage. We have the seller paying all closing costs. Got a 4.25% fixed rate. The inspection just got done and guy found a slight sag in the roof, couple double pane windows have moisture in them, and a small gas leak in the furnace line. Other than that just minor things like a cracked outlet cover couple light bulbs need replacing, toilet seat needing tightening, and small cracks on the driveway. Seller already agreed to fix everything including the minor stuff, even before we asked. Contract is getting written up now.

Around 48th and Giles

When's the house warming?:biggrin:

I disagree with this. You can get a 30 year loan and pay it just like its a 15 year. That way if you ever lose your job, have medical issues, etc, you can pay less. Of course this would require you to have the follow through to put the extra money in each month.

I concur. Rates are so low right now there's not much of a difference between a 15 and 30 year loan, but the payment amounts will vary greatly. Unless your job is super secure, I'd go with the 30 year so you can build up a cushy emergency fund, and then tackle the mortgage if you want. However, I'd max out my 401(k) and ROTH IRA before prepaying the mortgage. Just my $0.02.

- Joined

- 18 July 2005

- Messages

- 2,636

I concur. Rates are so low right now there's not much of a difference between a 15 and 30 year loan, but the payment amounts will vary greatly. Unless your job is super secure, I'd go with the 30 year so you can build up a cushy emergency fund, and then tackle the mortgage if you want. However, I'd max out my 401(k) and ROTH IRA before prepaying the mortgage. Just my $0.02.

I like this advice.

Don't forget, you can also enjoy a significant tax deduction with your mortgage interest and property tax if your income level allows.

Good luck!

Similar threads

- Replies

- 14

- Views

- 768

- Replies

- 8

- Views

- 255