This lines up for me. my 1991 all original non-modified NSX with 53,000 miles was appraised at $65,000 CDN. Currency exchange rates are difficult to apply as I would only get US dollars if I titled it and sold it in the US. (complex and expensive)Funny enough, this week I've been creating a value assessment for a lower mileage NA1 NSX and came up with a current trend line representing Value based on mileage for 91-96 [3.0L] vehicles in fairly original condition on the retail/replacement value side. Below should provide some assistance to those who are trying to establish a reasonable agreed upon value to date. If anyone needs any further help with this sort of thing feel free to contact me.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

What are your insurance and total value of your 1991 Nsx?

- Thread starter Jinks

- Start date

So I did insure my car with the classic car insurance. But there are so many limitations. Saying that I can only drive the car to and from a car show. Etc. yours the same way?I have Safeco. If you insure it as a classic car, you can set the value of the car to whatever you as a consumer think it is worth. It will raise your premium of course. But what happens if you get into a minor accident in the NSX? It gets totaled... May as well pay now and laugh later. Rather than pay less and cry later.

$194.87 every 6 months with Ameriprise Ins Co (Costco)-----(some discount given since they also insure my home)

Actual Cash Value Policy

$250K/$500K----Bodily Injury Liability

$100K----Property Damage

$500 deductible Collision

$250 deductible Comprehensive

This is a 2 vehicle policy with 2 adult drivers and my NSX is my Daily Driver.

Most of you can speculate about the value / wisdom of having a stated value policy but let me say this as someone who has suffered a total loss of an NSX and been fully reimbursed under an ACV policy AND as someone who worked 5 years as an insurance adjuster --- including auto claims. I personally believe that you are paying too much, giving up personal freedom in using your vehicles at your own discretion, and most importantly you are LIMITING your eventual pay off in the event of a total loss.

An ACV policy requires the insurance company to pay you "actual cash value" at the time of the loss which is NOT determined by "book value". The insurance company is required to PROVE ACV by showing actual sales of similar vehicles in your market area. Since NSX sales are somewhat scarce they can go outside your immediate market area but nationwide values are the same (barring seasonal sales) so that doesn't really matter.

Actual Cash Value Policy

$250K/$500K----Bodily Injury Liability

$100K----Property Damage

$500 deductible Collision

$250 deductible Comprehensive

This is a 2 vehicle policy with 2 adult drivers and my NSX is my Daily Driver.

Most of you can speculate about the value / wisdom of having a stated value policy but let me say this as someone who has suffered a total loss of an NSX and been fully reimbursed under an ACV policy AND as someone who worked 5 years as an insurance adjuster --- including auto claims. I personally believe that you are paying too much, giving up personal freedom in using your vehicles at your own discretion, and most importantly you are LIMITING your eventual pay off in the event of a total loss.

An ACV policy requires the insurance company to pay you "actual cash value" at the time of the loss which is NOT determined by "book value". The insurance company is required to PROVE ACV by showing actual sales of similar vehicles in your market area. Since NSX sales are somewhat scarce they can go outside your immediate market area but nationwide values are the same (barring seasonal sales) so that doesn't really matter.

Very interesting GO KRT. What is the difference between ACV and guaranteed value, as written in my Hagerty policy. Thank you.

Last edited:

Negative. Only restriction is 5,000 miles per year. Value is set to whatever I want it set at.So I did insure my car with the classic car insurance. But there are so many limitations. Saying that I can only drive the car to and from a car show. Etc. yours the same way?

Negative. Only restriction is 5,000 miles per year. Value is set to whatever I want it set at.

I think you have this restriction also: (from their FAQ page)

[h=4]Do I have to keep my classic car in a garage?[/h]Yes. In order to qualify for classic car coverage, your car must be stored in an enclosed, locking garage or storage facility.

It would be interesting to read the ACTUAL POLICY. "Some" classic insurance coverages forbid owners to drive their vehicles to the grocery store or mall. Yes, that would include Cars 'n Coffee events so be careful.

Shoot me a copy of the policy and I will read it.

[email protected]

Very interesting GO KRT. What is the difference between ACV and guaranteed value, as written in my Hagerty policy. Thank you.

I've read numerous posts about your car tabasco. In YOUR case the ONLY way you will get an insurance company to pay $100,000 for your car in a total loss situation would be in a stated value policy like you have with Hagerty. On one hand I'm surprised they agreed to go that high but on the other hand as long as you are willing to pay $$$$$$$$$$$$ in premiums they will be happy to take it

$194.87 every 6 months with Ameriprise Ins Co (Costco)-----(some discount given since they also insure my home)

Actual Cash Value Policy

$250K/$500K----Bodily Injury Liability

$100K----Property Damage

$500 deductible Collision

$250 deductible Comprehensive

...

You are underinsured with only $100k in property damage, and that is why your policy is less expensive. I have the perfect example also.

Two years ago our nanny was in a MVA and hit two other cars. One was a Panamera S and the other was a Hyundai. The Porsche was valued at $110k and the Hyundai at $21k. Plus there was damage done to shrubs for a few thousand. If I only had $100k in Property Damage I would have been personally responsible for the ~$40k difference. Furthermore, around my town there are $150k to $500k cars driven all the time. I upped my property damage from $300k to $500k immediately after that incident. You can never have too much insurance if you live in an area with a lot of high dollar cars on the road.

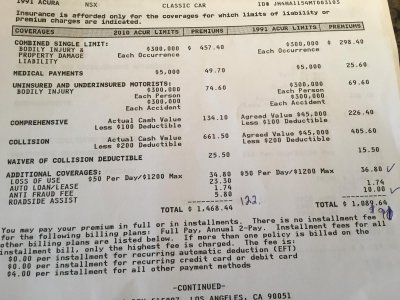

Yes of course it needs to be garaged,that is a given. What I meant by no restrictions is where and when I choose to drive it. My copies of the policy doesn't get into extensive classic car coverage but here is a snap shot of my current plan. Keep in mind, my car is salvaged due to being a theft recovery. I put a lot of money into the car so when I upgraded my policy I was able to set the value at whatever I deemed necessary. I set it to 45k total loss. I also have 3 others cars on the plan so I wouldn't go by the prices. But it is insured as a classic car, it is insured as a salvaged vehicle, and if I put more money into the car, which I do or if market prices raise, I can raise the total loss value. I would give Safeco a call. I also made a small claim with them back before I put so much money into the car. They valued the damage at like 2500 dollars. After providing actual costs, they cut me a check for 8k and I also remained not at fault even though there was no one else involved. But now I am under their classic car coverage which wasn't very much more at all. Like 10 dollars more per month...I think you have this restriction also: (from their FAQ page)

Do I have to keep my classic car in a garage?

Yes. In order to qualify for classic car coverage, your car must be stored in an enclosed, locking garage or storage facility.

It would be interesting to read the ACTUAL POLICY. "Some" classic insurance coverages forbid owners to drive their vehicles to the grocery store or mall. Yes, that would include Cars 'n Coffee events so be careful.

Shoot me a copy of the policy and I will read it.

[email protected]

Attachments

Thank you. To me $2000 is small amount to feel comfortable. I hope all you read about my NSX was good.

What year is your nsx?Thank you. To me $2000 is small amount to feel comfortable. I hope all you read about my NSX was good.

Off of the Safeco site.

http://www.safeco.com/classic-car-insurance/features

http://www.safeco.com/classic-car-insurance/features

2000

Smart move then getting a good insurance policy....2000

You are underinsured with only $100k in property damage, and that is why your policy is less expensive. I have the perfect example also.

Two years ago our nanny was in a MVA and hit two other cars. One was a Panamera S and the other was a Hyundai. The Porsche was valued at $110k and the Hyundai at $21k. Plus there was damage done to shrubs for a few thousand. If I only had $100k in Property Damage I would have been personally responsible for the ~$40k difference. Furthermore, around my town there are $150k to $500k cars driven all the time. I upped my property damage from $300k to $500k immediately after that incident. You can never have too much insurance if you live in an area with a lot of high dollar cars on the road.

Funny you should bring this up

After pulling my policy and posting the info I took a long bike ride. While riding I was thinking about my "low limit" on PD and told myself I was going to call my insurance company when I got home to ask how much it costs incrementally to increase. I was surprised when the girl said I had the highest limits on BI/PD that they offer (which explains why I only had $100K PD). HOWEVER, she then told me I could get an umbrella policy and switched me to someone who could give me a quote. "Richard" asked me quite a few questions about my personal life.......Did I have a boat? Swimming pool? Dog?........then told me that I could have a $1 Million umbrella policy for $195 / yr for both home and auto with an additional $13 added to homeowners to add additional coverage for "personal injury" (slander/libel.....). He also told me that by adding the umbrella policy to my existing policies my premiums would be REDUCED by approx $100/yr for auto and $50/yr for homeowners. He will be calling me back Monday with exact figures and I am sure I will be adding this umbrella coverage.

I'll post the new premium figures Monday afternoon.

BTW.....increasing liability coverage is one of the LEAST EXPENSIVE things you can add to your policy(unless you have a horrific driving record) so my premiums were not low just because i only had $100K PD coverage .

Last edited:

Off of the Safeco site.

http://www.safeco.com/classic-car-insurance/features

That's interesting but the actual policy is your contract with the insurance company and when you read that contract you have to pay attention to not only what they "cover" but the exclusions and definitions (and ALL the words). Adjusters actually go to school to read those policies. C

ontrary to popular opinion they aren't out to "screw the insured" but they are obligated to do whatever those words contained within that contract (policy) state.

I do not worry about it that much brotha. As I mentioned my wife is the legal might. Which is why Safeco reversed my small claim from at fault to no fault. All you need is good legal representation.... Facts mean nothing...That's interesting but the actual policy is your contract with the insurance company and when you read that contract you have to pay attention to not only what they "cover" but the exclusions and definitions (and ALL the words). Adjusters actually go to school to read those policies. C

ontrary to popular opinion they aren't out to "screw the insured" but they are obligated to do whatever those words contained within that contract (policy) state.

I would only say to anyone here involved in a minor or major accident, your not doing yourself a favor by not hiring an attorney. No matter what you think you have as coverage. Insurance companies do not want to pay these costs no matter who they are or how much you pay them. Lawyers put them in check though. I am happy with my current plan. I have the coverage I need with no worries.

I would only say to anyone here involved in a minor or major accident, your not doing yourself a favor by not hiring an attorney. No matter what you think you have as coverage. Insurance companies do not want to pay these costs no matter who they are or how much you pay them. Lawyers put them in check though. I am happy with my current plan. I have the coverage I need with no worries.

Although it's popular opinion that insurance adjusters are paid a bonus to find excuses not to pay Insurance companies are contractually bound to pay based upon the wording of the contract. If you don't want to read your policy have your wife read it. "IF" it says you can't drive your car to the grocery store or mall and you do that IN VIOLATION OF THE CONTRACT 10 lawyers won't be able to make them pay.

You "always catch more flies with honey". My suggestion when there is only Property Damage involved is to turn the claim in and let the process take its course. "IF" you are not satisfied with the outcome and you have an ACV policy you can hire a Public Adjuster (approx $450) who will provide an evaluation on your behalf. You can also file a claim with whatever department your state has that controls the insurance companies..........Unfair Claims Practices Act. Lawyers don't work for free (unless you're married to them) so if you feel like giving them 25-50% of your settlement you can always do that as well but on a claim that is property damage only that should be your last resort and you should only do it if you are in a state that allows you to recover legal expenses as part of your suit.

Now........back on point which I think was "How much do we pay"........

If you get a stated value policy you will have restrictions on use of your car and any use outside of the agreed contract means you get paid $0 so be very careful and know what your policy says. ( READ IT-don't assume ) If you KNOW what the policy says regarding restrictions and you are OK with them and feel as though the higher premium for stated value is worth it then by all means that is the direction you should go.

I know from a past total loss that I had with an NSX that my insurance company paid me top dollar on an ACV policy so I am comfortable with paying less and having more personal freedom with usage of my car.

IF anyone is still interested in "what are your insurance and total value of your 1991" I will post my new rates on Monday. FWIW mine is a 91 which had 26K at purchase and now has 32K in less than a year.

I have Safeco. If you insure it as a classic car, you can set the value of the car to whatever you as a consumer think it is worth. It will raise your premium of course. But what happens if you get into a minor accident in the NSX? It gets totaled... May as well pay now and laugh later. Rather than pay less and cry later.

I'm in the market for new insurance for all my cars and I'm going to put my NSX a classic car insurance. I've gotten quotes from Safeco for all under one policy but they would not give me an agreed valve over $75k for the nsx.

Jlinks, how's it having Safeco as an insurance they gave me a great quote for all 4 of my cars but after google their reviews I was very concern about them if I ever needed to exercise my policy. I have Allstate now and I'm being rape by them.

I'm leaning towards Hagerty for my nsx insurance they have a little less restriction than Grundy.

I have not had any issues. Also ,to anyone reading my posts please know that I am not an insurance adjuster or a whiz at numbers, I am just a regular guy. Safeco does have some bad reviews. As I mentioned when I had a minor incident which destroyed my marga hills body kit, they quoted me a very low number. I did not freak out though, I pulled costs of a new bumper, rocker panels, and rear valence from sos, and provided my adjuster with those costs as well as paint. Which they paid without question. They did try to say I was at fault months later when technically I was not. One letter from a lawyer made them reconsider. I also have had very small claims on my other vehicles like windshields or dents. Overall I am happy with them. I am unaware of a 75k cap on the nsx though. Mine would never be worth that much anyhow. There are better insurance companies I am sure of that. But I just jump in and drive when I want with this current plan. I also really like the super low deductible with Safeco. When I got the plan I spoke to a broker over the phone, it is just how I like to do business. The best thing about Safeco is that I can have all my cars under 1 policy rather than 3 cars on one and the nsx through haggerty or comparable classic car plans. Hope this helps if any. :wink:I'm in the market for new insurance for all my cars and I'm going to put my NSX a classic car insurance. I've gotten quotes from Safeco for all under one policy but they would not give me an agreed valve over $75k for the nsx.

Jlinks, how's it having Safeco as an insurance they gave me a great quote for all 4 of my cars but after google their reviews I was very concern about them if I ever needed to exercise my policy. I have Allstate now and I'm being rape by them.

I'm leaning towards Hagerty for my nsx insurance they have a little less restriction than Grundy.

What policy/company did you choose? Interested to know. Sounds like your much more detailed than I am on stuff, so please continue.Although it's popular opinion that insurance adjusters are paid a bonus to find excuses not to pay Insurance companies are contractually bound to pay based upon the wording of the contract. If you don't want to read your policy have your wife read it. "IF" it says you can't drive your car to the grocery store or mall and you do that IN VIOLATION OF THE CONTRACT 10 lawyers won't be able to make them pay.

You "always catch more flies with honey". My suggestion when there is only Property Damage involved is to turn the claim in and let the process take its course. "IF" you are not satisfied with the outcome and you have an ACV policy you can hire a Public Adjuster (approx $450) who will provide an evaluation on your behalf. You can also file a claim with whatever department your state has that controls the insurance companies..........Unfair Claims Practices Act. Lawyers don't work for free (unless you're married to them) so if you feel like giving them 25-50% of your settlement you can always do that as well but on a claim that is property damage only that should be your last resort and you should only do it if you are in a state that allows you to recover legal expenses as part of your suit.

Now........back on point which I think was "How much do we pay"........

If you get a stated value policy you will have restrictions on use of your car and any use outside of the agreed contract means you get paid $0 so be very careful and know what your policy says. ( READ IT-don't assume ) If you KNOW what the policy says regarding restrictions and you are OK with them and feel as though the higher premium for stated value is worth it then by all means that is the direction you should go.

I know from a past total loss that I had with an NSX that my insurance company paid me top dollar on an ACV policy so I am comfortable with paying less and having more personal freedom with usage of my car.

IF anyone is still interested in "what are your insurance and total value of your 1991" I will post my new rates on Monday. FWIW mine is a 91 which had 26K at purchase and now has 32K in less than a year.

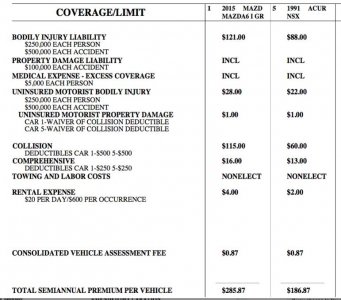

Insurance Rate for Auto

I added the $1 Million dollar umbrella to my auto (BOTH cars included)--- and my home today for a total cost of $208.00---Ameriprise Ins Co (Costco)

My final figure for insuring the NSX is shown on this Declarations Page attached---$186.87 every 6 months. I do not have towing coverage on my auto policies since I have AAA.

All I can say ----- as a former insurance adjuster ---- is MAKE SURE you KNOW what your policy actually says. Don't get caught with $0 coverage on a $100,000 stated value policy because you left your car out of the garage or drove it to the supermarket or mall shopping center or went 1 mile over your annual limit. Your policy might not have these exclusions but READ THE POLICY.

I added the $1 Million dollar umbrella to my auto (BOTH cars included)--- and my home today for a total cost of $208.00---Ameriprise Ins Co (Costco)

My final figure for insuring the NSX is shown on this Declarations Page attached---$186.87 every 6 months. I do not have towing coverage on my auto policies since I have AAA.

All I can say ----- as a former insurance adjuster ---- is MAKE SURE you KNOW what your policy actually says. Don't get caught with $0 coverage on a $100,000 stated value policy because you left your car out of the garage or drove it to the supermarket or mall shopping center or went 1 mile over your annual limit. Your policy might not have these exclusions but READ THE POLICY.

Attachments

Last edited:

Hagerty for $1400 annual for both my NSX and agreed value of 40 and 45000 with a combined 5000 miles a year. I was paying $1863 for both with Usaa but no agreed value

Similar threads

- Replies

- 3

- Views

- 505

- Replies

- 3

- Views

- 572

- Replies

- 7

- Views

- 769

- Replies

- 5

- Views

- 208