You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

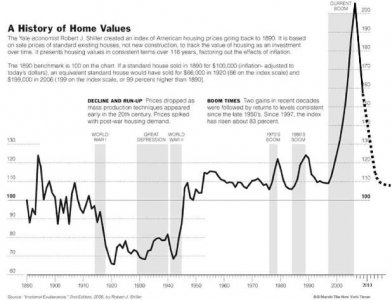

Housing Chart

- Thread starter steveny

- Start date

steve, thx for this. reading the link text was interesting. for those who didn't see the text, i've copied an interesting bit here:

"Mr. Frank has big plans for your tax dollars, "We may need more than $50 billion for foreclosure [mitigation]". What this means is that you will be making your monthly mortgage payment and in addition you will be making a $100 payment per month for a deadbeat who bought more house than they could afford, is still watching a 52 inch HDTV, still eating in their perfect kitchens with granite countertops and stainless steel appliances." (my b+i)

funny he should say this. i know of neighbors / others homes i've visited that fit this to a t. my wife and i would visit - and be duly impressed with the nice environment - and on the way home i'd usually say, "geez, it'd be nice to have that but who wants to pay for it when they'll never get it back on resale? not this momma's boy."

as we near a formal retirement date, i really despise the idea of our home falling price another 25% off the bubble-inflated price we could have gotten a few years ago, but having said that, it seems to me our economy / citizens have to take our medicine / hit and let the cards fall where they will.

with today's downdraft in the market, i can't help but feel we're heading down even further before it even appears to be getting better.

quite a mess our country has gotten itself in to, i'm afraid.

quite a mess our country has gotten itself in to, i'm afraid.

Who is John Galt?

Looking at that chart and I'm surprised at how lucky I was to buy my house in 1997.

At least I hope so ...

...

At least I hope so

i'd never hear of john galt so googled and found this:Who is John Galt?

http://en.wikipedia.org/wiki/John_Galt

i've only done a quick run-through of it but will return to it for reading over the next few days.

interesting.

you know, i was thinking the same thing wrt our home (we bought in '98). i guess we'll find out if / how lucky we are as things unfold, eh?Looking at that chart and I'm surprised at how lucky I was to buy my house in 1997.

At least I hope so...

Home price as a multiple of income... :scratch head:

It's worse than that image depicts as well. You might infer incomes have been steady, which is not the case. Real wages have been going down for half a decade.

Anyone who has a leveraged bet on the housing market is destroyed. Completely healthy banks that bought toxic banks (BAC->CFC->MS) for pennies paid billions too much. Hold on tight, it's going to stay a bumpy ride.

Anyone who has a leveraged bet on the housing market is destroyed. Completely healthy banks that bought toxic banks (BAC->CFC->MS) for pennies paid billions too much. Hold on tight, it's going to stay a bumpy ride.

Anyone who has a leveraged bet on the housing market is destroyed.

Not anyone as property here continues to go up.

There is a prime member who bought a rental here in 2006. That property is now worth 30% more than it was in 2006. Slow and steady wins the race. Houses never went wildly up in price here the only thing that changed was who could get a loan.

I think the chart is close, but wrong. The chart assumes we'll do a "nice" landing back down to $110,000 but I think we're going to over correct by a large amount.

Look for the Nation Average for homes to be under $80,000.

Everyone has seen how bad the drop from around $220,000 to $180,000 has been(I think those are the right numbers?).

If we're not even 1/2 way done, and interest rates can't go any lower, and China is out of money to loan us.....

We're screwed big time.

.

Look for the Nation Average for homes to be under $80,000.

Everyone has seen how bad the drop from around $220,000 to $180,000 has been(I think those are the right numbers?).

If we're not even 1/2 way done, and interest rates can't go any lower, and China is out of money to loan us.....

We're screwed big time.

.

Last edited:

I think the chart is close, but wrong. The chart assumes we'll do a "nice" landing back down to $110,000 but I think we're going to over correct by a large amount.

Look for the Nation Average for homes to be under $80,000.

Everyone has seen how bad the drop from around $220,000 to $180,000 has been(I think those are the right numbers?).

If we're not even 1/2 way done, and interest rates can't go any lower, and China is out of money to loan us.....

We're screwed big time..

We are screwed but the rest of the world is getting gang raped.

Not anyone as property here continues to go up.

There is a prime member who bought a rental here in 2006. That property is now worth 30% more than it was in 2006. Slow and steady wins the race. Houses never went wildly up in price here the only thing that changed was who could get a loan.

By leveraged bet I was referring to securities. I don't think there are many tranches that contain mostly rising property values.

Similar threads

- Replies

- 31

- Views

- 4K

- Replies

- 16

- Views

- 1K

- Replies

- 0

- Views

- 199

- Replies

- 10

- Views

- 786